Does FTX Still Exist? An Update On The Defunct Crypto Exchange

The question of whether FTX, that once very prominent name in the world of digital money, still holds any ground is one many folks are still asking. For a time, this particular spot for trading cryptocurrencies and managing a special kind of investment fund was quite the big deal, a real shining light for many who were interested in digital assets. So, to be honest, it was a place where a lot of activity happened, and many people put their trust in it for their financial dealings, which is a pretty big thing when you think about it.

It's a very common query, given the significant events that unfolded with this company. Many people remember when FTX was, in a way, at the top of its game, drawing in a lot of attention and funds from around the globe. This was a spot where you could buy and sell different digital coins, and it also had a part of its operations dedicated to making strategic investments with those very digital assets, so it was quite a comprehensive setup for its users.

However, the story took a rather dramatic turn, leading to a situation where the company, which was known as FTX Trading Ltd., found itself in a state of financial ruin. This shift from a widely recognized leader to a business that had gone under financially has, in some respects, left many wondering about its current standing. We'll explore what became of it and what that means for those who were involved, or just curious, about this significant part of the digital money landscape.

- Howard Morley Oregon

- Kalogeras Sisters House Location Google Maps

- Eva Maxim

- Credit One Customer Service Chat

- Anfisa Todo En 90 Dias

Table of Contents

- What Was FTX?

- The Sudden Downfall of a Crypto Giant

- Is FTX Still Operating? The Current Status

- The Bankruptcy Process: What's Happening Now?

- Lessons from the FTX Saga

- Frequently Asked Questions (FAQs)

What Was FTX?

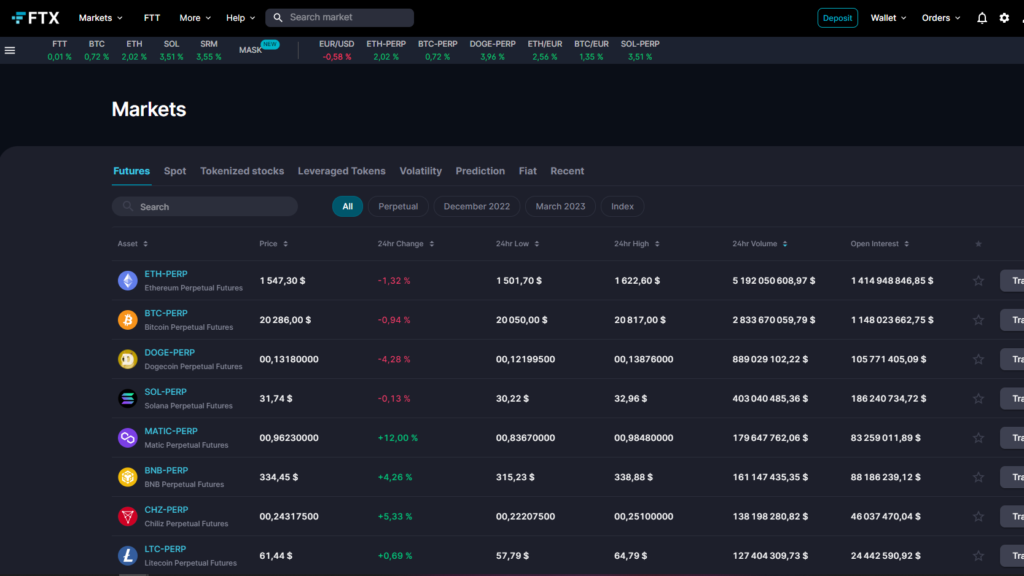

FTX, or FTX Trading Ltd., was once a very prominent name, a real star, in the world of digital currencies. It operated as a cryptocurrency exchange, which is essentially a place where people could trade various digital coins, and it also managed a crypto hedge fund. This means it was involved in making strategic investments with digital assets, trying to grow its holdings, which is pretty interesting when you think about it.

The business was established, and for a period, it was considered a very well-known spot for trading digital money, drawing in a lot of users. Its platform, which was used for trading these digital assets, was, in a way, a central hub for many who wanted to get involved with cryptocurrencies. It was, apparently, a significant player in the market, providing services to a large number of people who were looking to buy, sell, or hold digital assets.

People often saw it as a strong, reliable place for their digital currency needs. It had, you know, a reputation for being a major player, and many users entrusted their funds to it. The company's reach extended quite a bit, with its Bahamian part, FTX Digital Markets, being a key piece of its overall structure, which is something to consider when looking at its past operations.

The Sudden Downfall of a Crypto Giant

The story of FTX, however, took a very sharp turn, leading to its sudden collapse. This digital money trading spot, which was once so widely recognized, became defunct after it fell apart about a year ago. It was, in fact, a leading cryptocurrency exchange that went financially under in November 2022, and this happened amidst serious claims that its owners had taken and misused money belonging to the people who used its services, which is quite concerning.

The company's downfall was, frankly, attributed to a combination of very poor handling of its operations and the mixing of its own money with the funds of its associated company, Alameda Research. There was also a notable absence of proper internal checks and ways to manage risks within the business. This situation, in short, created a significant problem that eventually led to its inability to continue functioning.

A sudden increase in the amount of money people wanted to take out from the platform exposed a very large financial gap, estimated at around $8 billion. This event, basically, was the trigger for the company's ultimate failure. It showed that the internal financial structure was not as sound as many had believed, which really highlights the importance of strong financial oversight in such operations.

A Timeline of Trouble

The sequence of events leading to FTX's financial ruin happened quite quickly. On a Friday morning, FTX and its related businesses, including Alameda Research, which was its linked digital money trading operation, officially asked for protection under Chapter 11 bankruptcy laws in the United States. This filing, in a way, marked a formal recognition of their severe financial difficulties.

This request for bankruptcy protection happened in November 2022. The digital money exchange, along with its U.S. branch, FTX.US, both filed for this protection. This step, which is a significant legal process, was a direct consequence of the issues that had been brewing within the company, indicating a profound financial crisis that they were unable to overcome, which is a rather sad turn of events for many.

Is FTX Still Operating? The Current Status

To directly answer the question, FTX, the company that once ran a cryptocurrency exchange and a crypto hedge fund, is a business that has gone bankrupt. It is, basically, a defunct company, meaning it is no longer operating in the way it once did, as a live trading platform. The cryptocurrency trading platform, in fact, is defunct after it fell apart a year ago, which is a pretty clear indication of its current state.

The exchange itself is no longer active for trading. Its operations ceased when it experienced its dramatic financial collapse. So, when people ask, "Does FTX still exist?", the answer is that the entity known as FTX Trading Ltd. still exists as a bankrupt entity going through legal processes, but its core function as a live trading venue for digital assets has, you know, completely stopped. It's not a place where you can go and trade digital money today.

The company's legal and financial situation is still, in some respects, very much in progress. The FTX bankruptcy process is, apparently, still ongoing, which means there are many legal and financial steps being taken to resolve its affairs. This status means it's not a functioning business, but rather a legal case being worked through, which is a very different kind of existence for a company.

The Bankruptcy Process: What's Happening Now?

The process of dealing with FTX's financial ruin is a complex and extended one. The company has made announcements regarding plans to return money to most of the people who used its services, which is a significant step, and this is set to happen two years after it originally fell apart. This effort to pay back its customers is a major part of the ongoing legal work, and it's a topic that many people are following very closely, naturally.

This whole situation, you know, reached a point where the company, which was once a star in the digital money space, had to face its financial shortcomings. The former chief executive of FTX, who was responsible for its growth, is part of this story. As the person in charge, he oversaw its expansion, and now, the company's financial troubles are being handled through a formal bankruptcy proceeding, which is quite a process.

Repaying Customers: The Long Road

The journey to get money back to the people who used FTX's services is a rather drawn-out one. FTX Digital Markets, which is the Bahamian part of the company that is no longer in operation, will start giving back money to those it owes on February 18, 2025. This date is, basically, a key moment for many who are waiting to see some resolution to their financial losses, which is a very important point for them.

The parent company, FTX, which has gone financially under, also stated that it will begin the next round of giving cash back on September 30, 2025. This announcement came on a Wednesday, indicating a planned schedule for these repayments. This date is, in fact, after a U.S. bankruptcy court gave its approval, which allowed for a significant amount of money, about $1.9 billion, to be made available by reducing FTX’s disputed claims, so that's a positive development for those awaiting funds.

The defunct digital money exchange expects to make these next payments to its creditors on September 30, after that $1.9 billion was made available by the bankruptcy court. This movement towards returning funds is, in a way, a sign that the long process is moving forward, offering some hope to the estimated more than 1 million customers who might be facing losses after FTX, which was one of the biggest digital money exchanges at the time, suddenly fell apart and asked for bankruptcy protection.

The FTT Token's Fate

As FTX and Alameda Research go through the bankruptcy process, there is, honestly, little to give people who invested hope that the FTT token, which was FTX's own digital coin, has any real underlying worth. Experts in the field, you know, have said this, suggesting that the token's future is not looking particularly bright given the circumstances.

The FTT token, which is the native digital coin of FTX, continues to struggle in the market. Its value is, apparently, not performing well, even as the company moves forward with its plans to pay back customers and settle legal matters following its collapse in 2022. This struggle for the token indicates that its connection to the defunct exchange has, in some respects, significantly impacted its standing in the broader digital currency market.

Lessons from the FTX Saga

The story of FTX offers some very clear takeaways about the digital money world. The collapse of FTX, which was brought on by a sudden surge in customer requests to take out their money, revealed a large financial gap. This situation, in a way, showed the dangers of severe mismanagement, the mixing of funds between different parts of a business, and a clear lack of proper internal checks and ways to handle risks.

The experience with FTX, you know, really highlights the importance of strong internal controls and careful risk management for any business, especially those dealing with large amounts of people's money. It also, arguably, underscores the need for transparency and clear separation of funds within financial operations. This whole event, basically, serves as a powerful reminder of what can happen when these fundamental business practices are not followed, which is a rather important lesson for everyone involved in digital assets.

While the FTX story seems to be coming to a close in terms of its legal processes and customer repayments, its impact on the digital money space is, in some respects, still very much felt. It has prompted many to consider the stability and security of other platforms. To learn more about keeping your digital assets safe, you might want to explore ways to secure your crypto on our site, which is a good idea for anyone with digital money.

Frequently Asked Questions (FAQs)

Many people have questions about FTX and its current situation. Here are some common queries that come up, which might help clarify things for you.

Is FTX still operating?

No, the company that once ran the FTX cryptocurrency exchange is a business that has gone bankrupt. It is, basically, a defunct company and no longer operates as a live trading platform for digital money. Its trading services stopped when it fell apart in November 2022, which is a pretty definitive answer.

When will FTX customers get their money back?

FTX has made announcements about returning money to most of its customers. FTX Digital Markets, its Bahamian part, will begin repaying people on February 18, 2025. The main FTX entity, which has gone financially under, expects to start its next round of cash distribution on September 30, 2025, after a U.S. bankruptcy court made funds available, so those are the key dates to keep in mind, you know.

What caused FTX to collapse?

FTX fell apart due to a combination of very poor handling of its operations, the mixing of its own money with funds from its associated company, Alameda Research, and a notable absence of proper internal checks and ways to manage risks. A sudden increase in the amount of money people wanted to take out from the platform exposed a very large financial gap, which was the main trigger for its downfall, which is a rather clear explanation of what happened.

For more insights into the world of digital currencies and their underlying principles, you might want to explore the basics of digital currencies here. Understanding the fundamentals can help you better grasp events like the FTX situation. You can also find additional information about the broader financial landscape by checking out reputable sources, like a well-known financial news outlet, which is always a good practice.

FTX review and how to use it - The Crypto Trading Blog

/cdn.vox-cdn.com/uploads/chorus_image/image/71636068/GettyImages_1244772036.8.jpg)

Sam Bankman-Fried, FTX, and the beginning of the crypto ice age - Vox

What Happened With FTX And What Does It Mean?