How Much Is The Rothschild Family Worth? Unpacking A Legendary Fortune

For generations, a question has sparked curiosity and discussion: how much is the Rothschild family worth? It is a query that brings up images of immense wealth, secret dealings, and vast influence. People often wonder about the true scale of their fortune, a fortune that has shaped history in many ways. This family name, Rothschild, often comes up when talking about powerful financial dynasties. Their story, stretching back centuries, involves grand financial dealings and a quiet, private approach to their money. Trying to put a single number on their wealth is, in a way, like trying to count all the stars in the night sky.

This family's financial story is quite unique. It started a long time ago and grew through smart business moves across many countries. The Rothschilds built a network that was very strong and lasting. Their wealth is not just about money in a bank; it is tied to businesses, properties, and even art collections that have been passed down through the years. So, the idea of truly figuring out their collective worth is a rather complex puzzle. What we can do, however, is explore their journey, look at how they built their fortune, and consider what their financial standing might mean in today's world. This exploration helps us better understand a very famous, yet somewhat mysterious, family.

The interest in the Rothschild family's wealth remains high, even today, in early 2024. People often search for current figures, hoping to grasp the scale of their financial power. This ongoing interest shows how much impact their story has had on the world. Their wealth is a subject of many discussions, from historical talks to modern financial analysis. It seems that the question of "how much" will always be a big part of their public image, drawing new curious minds to their long and interesting history.

Table of Contents

- The Rothschild Story: From Humble Beginnings to Financial Powerhouse

- What Does "Much" Even Mean When We Talk About Such Wealth?

- Estimating the Rothschild Family's Wealth Today

- The Rothschild Legacy: Beyond Just Money

- Common Questions About the Rothschild Family's Fortune

- Looking Ahead: The Rothschilds in the Modern Financial World

The Rothschild Story: From Humble Beginnings to Financial Powerhouse

The story of the Rothschild family's great wealth begins in the Jewish ghetto of Frankfurt, Germany. It was here, in the mid-18th century, that Mayer Amschel Rothschild started his journey. He was a very clever man with a good head for business. His early work involved dealing in rare coins and trading goods. This simple start, you know, laid the groundwork for something truly massive. He was quite smart in how he handled his dealings, building trust with important people.

Mayer Amschel had a vision, a plan that went beyond just one city. He understood the power of family bonds in business. This was a time when communication was slow, and trust was everything. He saw a way to expand his business by sending his sons to key cities across Europe. This strategy, you see, was truly ahead of its time. It allowed the family to act as one big financial unit, even when spread far apart. This unified approach gave them a very strong edge over others.

The family's rise was not sudden. It was built piece by piece, through careful planning and hard work. They were very good at spotting opportunities, especially during times of political change. Wars and shifting powers often created financial needs, and the Rothschilds were always ready to step in. Their ability to move money quickly and secretly across borders gave them a unique advantage. They really became a go-to source for governments needing funds.

A Family's Rise: Mayer Amschel Rothschild

Mayer Amschel Rothschild was the founder of this amazing financial dynasty. He was born in 1744. His early life was quite humble, yet he had a sharp mind for numbers and trade. He learned the banking trade from his father, who also dealt in coins and foreign exchange. After his father passed, Mayer Amschel continued the family business. He started small, building relationships with local princes and nobles. This was, in a way, his first big step.

He was particularly good at handling the finances for William IX, Landgrave of Hesse-Kassel. This relationship proved to be very important for his family's future. Mayer Amschel was known for his discretion and reliability. These qualities, it's almost, made him a trusted financial advisor. He built a reputation for being someone you could count on with large sums of money. This trust was a key part of his growing success.

Mayer Amschel Rothschild had five sons. He trained each of them in the ways of finance. He gave them clear instructions to work together, to always support each other's ventures. This family unity, you know, was a core principle he instilled. It was a rule that would ensure the family's power would grow and stay strong for generations to come. He passed away in 1812, leaving behind a truly powerful foundation.

| Detail | Information |

|---|---|

| Full Name | Mayer Amschel Rothschild |

| Born | February 23, 1744 |

| Birthplace | Frankfurt am Main, Holy Roman Empire (now Germany) |

| Died | September 19, 1812 |

| Occupation | Founder of the Rothschild banking dynasty, coin dealer, financier |

| Key Contribution | Established the family's international banking network through his five sons. |

The Five Arrows: Spreading Influence Across Europe

Mayer Amschel Rothschild's five sons became known as "the five arrows." This was a symbol of their unity and strength. Each son was sent to a major European financial center. Nathan Mayer Rothschild went to London, James Mayer Rothschild to Paris, Amschel Mayer Rothschild stayed in Frankfurt, Salomon Mayer Rothschild went to Vienna, and Carl Mayer Rothschild went to Naples. This strategic placement was, you know, a very smart move.

This network allowed the family to share information quickly. They could move capital across borders with great speed. This was especially important during the Napoleonic Wars. They financed armies and governments, often on opposing sides. Their ability to do this, to act as a neutral financial force, gave them immense power. They truly became the bankers to Europe's elite. Their influence grew very large during this time.

The brothers worked as one, supporting each other's banks. If one branch needed funds, the others would provide it. This mutual support meant that the family's financial strength was always greater than the sum of its parts. They developed very clever ways to transfer money and information. They even had their own private courier service, which was much faster than official channels. This gave them, you see, a huge advantage in financial markets.

Their success was also built on a deep understanding of market trends and political events. They could predict changes and position themselves to benefit. This foresight, combined with their vast resources, made them incredibly powerful. They were involved in everything from government bonds to railway construction. Their reach, in a way, seemed to extend everywhere. The family became known for its discretion and its very long-term view of investments.

What Does "Much" Even Mean When We Talk About Such Wealth?

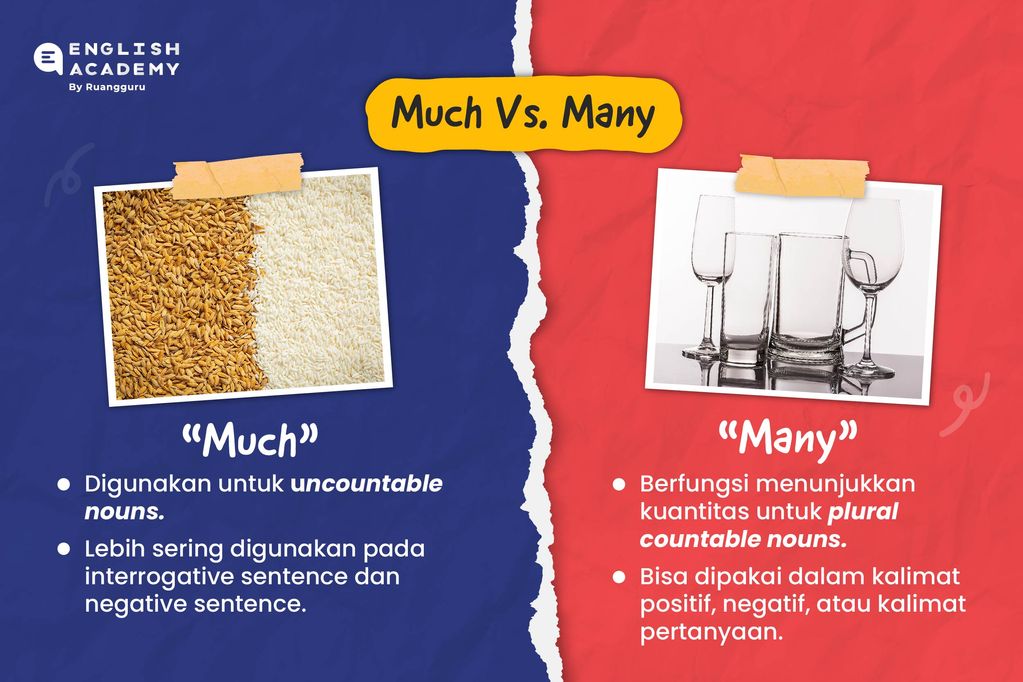

When people ask, "how much is the Rothschild family worth," they are, in a way, asking about a truly vast fortune. This word "much" itself points to a very large amount, a great quantity, or a significant extent. It indicates a substantial level of something, showing a notable difference from the usual. So, when we discuss the Rothschilds, we are talking about a degree of wealth that has been immense for a very long time, a fortune great in quantity, measure, or degree. It is, quite simply, a lot of money, far more than most can picture.

To understand what "much" means in this context, think about something that is far larger than you want or need, or a quantity that is hard to measure. The Rothschild family's wealth is like that. It's not just a big number; it represents generations of accumulated assets, investments, and businesses. This indicates a substantial extent or level of something, generally implying a significant or notable difference or impact. It is a large quantity or amount that has influenced economies and societies for centuries. So, when someone asks about their worth, they are asking about something truly significant.

The term "much" here describes a fortune that has been significant, important, major, and big in the world of finance. It refers to a substantial and meaningful amount of capital. Unlike a small or trivial sum, the Rothschilds' wealth is anything but minor or insignificant. It is a fortune that has been a driving force in many historical events. The question of "how much" reflects a general understanding that their wealth is not just considerable, but rather, on a scale that few other families have ever reached. It is a very large degree of financial power.

This idea of "much" also speaks to the ongoing nature of their wealth. It is not a one-time gain but a continuous flow of assets and value. The family has managed to keep and grow their fortune through many changes in the world. This means their wealth has always been a large quantity, an extent that has continued to be relevant and powerful. It is, you know, a testament to their lasting business practices and family unity. The word "much" truly captures the historical and ongoing scale of their financial holdings.

Estimating the Rothschild Family's Wealth Today

Figuring out the exact current worth of the Rothschild family is a very hard task. Unlike publicly traded companies, the family's wealth is spread across many private holdings, trusts, and different businesses. These assets are not reported in the same way. So, any number you hear is, you know, likely an estimate. It is very difficult to get a precise figure for such a private and dispersed fortune.

Many parts of their wealth are tied up in private banks, investment firms, and real estate. These are not easy to value publicly. Also, the family has many branches, each with its own financial dealings. This makes it even harder to get a single, combined total. Financial analysts and historians often try to piece together clues, but it's never a complete picture. The very nature of their wealth means it stays largely out of public view.

As of early 2024, there are no official, consolidated figures for the Rothschild family's total net worth. Estimates you might find online vary wildly, from hundreds of billions to even trillions of dollars. These numbers are often based on historical assets and a lot of guesswork. It is important to remember that these are just estimates, and the family itself does not release such figures. This secrecy is, you see, a long-standing tradition for them.

Why an Exact Figure is Elusive

The main reason an exact figure for the Rothschild family's wealth is so hard to find is its private nature. The family has, for a very long time, chosen to keep their financial dealings out of the public eye. They operate through private banks and holding companies. This means their financial statements are not available for public review. It is, in a way, a very intentional choice to maintain discretion.

Another reason is the sheer number of family members and their individual assets. The Rothschild family is vast, with many descendants living across the globe. Each branch and individual may have their own investments and businesses. Adding all these up, you know, would be a huge undertaking. There is no central ledger that combines all their personal and corporate wealth into one number. This makes any total figure very speculative.

Furthermore, much of their wealth is held in long-term assets like land, art, and historical properties. These can be hard to value accurately and can change in worth over time. They are not liquid assets that can be easily converted to cash. This makes it difficult to put a precise dollar amount on them. The family's approach to wealth is about preserving it across generations, not just about having a large, easily countable sum. It is a rather complex arrangement.

Different Ways to Look at Their Holdings

When trying to understand the Rothschilds' wealth, people often look at it in different ways. One way is to consider their historical assets. This includes the value of the banks they once owned outright, their vast land holdings, and their famous art collections. These historical assets, you see, represent a huge amount of past wealth. However, much of this has changed hands or been managed differently over the years.

Another way is to look at the value of the companies they still control or have significant stakes in today. For example, Rothschild & Co, a global financial advisory firm, is publicly traded. Its market value can be calculated. However, this is only one part of the family's total financial picture. Many other ventures are private. So, while Rothschild & Co's value is known, it does not tell the whole story of the family's overall wealth. It is just one piece of a very large puzzle.

We can also think about the family's collective influence. Their wealth allows them to invest in various sectors, from energy to technology. This influence, while not a direct dollar amount, is a form of power that comes from their financial standing. It means they can shape industries and support new ventures. This kind of wealth is about long-term impact, not just a snapshot of cash in hand. It is, you know, a very broad way to consider their financial power.

Some people also consider the value of their various trusts and foundations. These entities hold assets for the benefit of family members or for charitable causes. The money within these structures is managed for the

В чём разница между much, many и a lot of

Perbedaan Many dan Much Beserta Contohnya Bahasa Inggris Kelas 7

หลักการใช้ Much / Many / A lot of / lots of - Engcouncil